Trade Funding

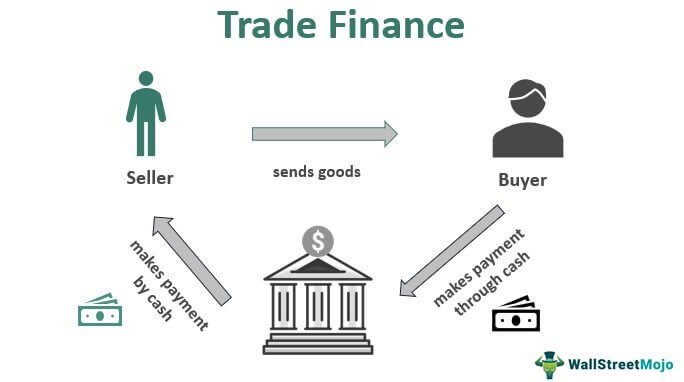

In the world of international trade, financing plays a crucial role in ensuring smooth and efficient transactions between buyers and sellers across borders. Trade funding refers to the various financial instruments and mechanisms that facilitate the movement of goods and services across different markets by providing necessary liquidity. It serves as the lifeblood of global commerce, enabling businesses to bridge gaps in working capital, mitigate risks, and seize new opportunities.

Definition and importance of trade funding

Trade funding encompasses a wide range of financial products and services designed specifically for businesses engaged in import-export activities or involved in supply chains. It involves securing funds to support every stage of a trade transaction, from pre-shipment to post-shipment. The primary goal is to address challenges related to cash flow gaps arising from timing mismatches between payment obligations and revenue realization.

The importance of trade funding cannot be overstated, particularly for small and medium-sized enterprises (SMEs) that often face limited access to traditional financing options. By providing access to working capital or credit facilities tailored for international trade, businesses can fulfill purchase orders, secure inventory, finance production processes, cover transportation costs, or even expand into new markets.

Historical background and evolution of trade funding

The concept of trade funding has been ingrained in human civilization since ancient times. As long-distance commerce began flourishing across cultures through the exchange of goods such as spices, textiles, precious metals, and agricultural products, methods for mitigating risks associated with delayed payments emerged.

One notable historical practice was the usage of bills of exchange during medieval times. Merchants would issue written orders instructing their debtors located elsewhere to pay a specific amount at a future date or upon arrival at a specified destination.

This precursor to modern-day promissory notes facilitated cross-border trade by assuring sellers that they would receive payment, even in the absence of physical currency. Over the centuries, trade funding has continued to evolve and adapt to the changing needs of global commerce.

The Industrial Revolution marked a significant turning point, as increased manufacturing capabilities and technological advancements fueled international trade growth. As a result, financial institutions began offering specialized services like letters of credit (LCs) and documentary collections – mechanisms aimed at mitigating risks and facilitating trust between trading partners.

In recent years, the digitization of financial processes and the emergence of fintech solutions have revolutionized trade funding. Technologies such as blockchain have introduced greater transparency, efficiency, and security into various financing methods.

Moreover, international organizations and governments have recognized the importance of fostering accessible trade finance for economic development, leading to the establishment of export credit agencies (ECAs) and multilateral development banks (MDBs). This historical background sets the stage for understanding how trade funding has evolved into its modern form—a diverse ecosystem consisting of traditional banking facilities, non-bank financing options, and government-supported programs.

Types of Trade Funding

Traditional Bank Financing

Traditional bank financing has long been a reliable source of trade funding for businesses engaged in international transactions. Among the various instruments used in this realm, Letters of Credit (LCs) hold a prominent position.

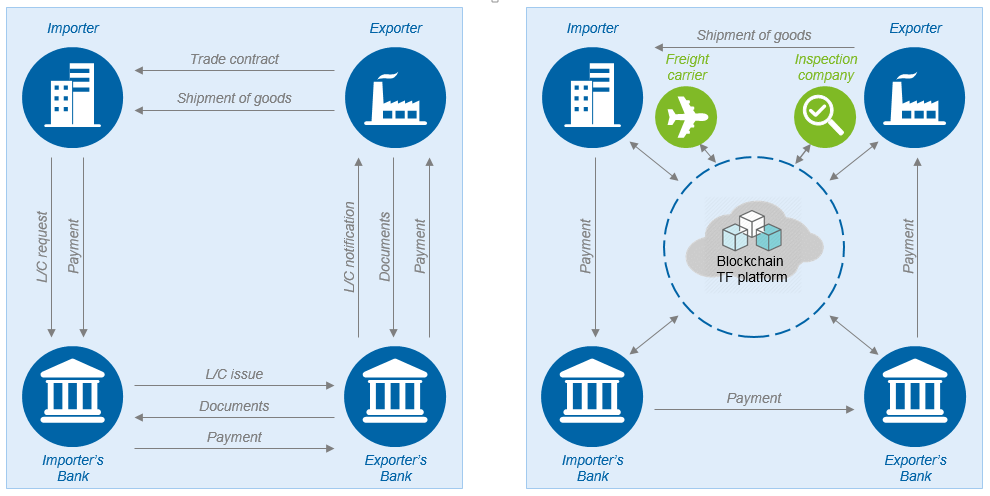

LCs serve as a crucial mechanism to mitigate risks and facilitate smooth transactions between exporters and importers. A Letter of Credit is essentially a guarantee issued by a bank on behalf of the buyer (importer) that assures the seller (exporter) will receive payment once certain conditions are met.

The primary purpose of LCs is to provide security to both parties involved, ensuring that the seller receives payment while assuring the buyer that goods or services will be delivered as agreed upon. There are different types of LCs, including revocable, irrevocable, and confirmed LCs.

Revocable LCs can be altered or canceled by the issuing bank without prior notice, making them less secure for exporters. Irrevocable LCs, on the other hand, cannot be modified or canceled without consent from all parties involved, offering greater protection to exporters.

Confirmed LCs add an extra layer of security by involving an additional bank (usually in the exporter’s country), which confirms its commitment to honor payment obligations even if the issuing bank fails. The process and parties involved in LC transactions include the importer (buyer), exporter (seller), issuing bank (buyer’s bank), advising/negotiating bank (exporter’s bank), and often an additional confirming bank if applicable.

The importer applies for an LC from their issuing bank, specifying terms and conditions such as shipping documents required for payment release. Once issued, it is then transmitted through an advising/negotiating bank to reach the exporter who ensures compliance with specified terms before presenting necessary documents for payment release.

Documentary Collections

Documentary collections offer an alternative to Letters of Credit for trade financing. This method involves the collection of payment from the importer by the exporter’s bank while shipping documents are sent directly to the importer. The primary purpose of documentary collections is to establish a secure means of ensuring payment while allowing importers greater control over document handling and goods clearance.

There are two main types of documentary collections: documents against payment (D/P) and documents against acceptance (D/A). In D/P collections, the exporter retains control over shipping documents until the importer makes payment, upon which they are released for goods clearance.

D/A collections, on the other hand, involve releasing shipping documents to the importer against their acceptance of a time draft or bill of exchange, essentially deferring payment until a specified future date. Comparing documentary collections with Letters of Credit reveals certain advantages and disadvantages.

While LCs provide greater security and assurance for both parties involved due to their bank-backed nature, documentary collections offer more flexibility and reduced costs as they involve less bank intervention. However, exporters may face higher risks in terms of non-payment with documentary collections compared to LCs.

Non-Bank Financing Options

In addition to traditional bank financing methods like LCs and documentary collections, there are non-bank financing options available for businesses engaged in trade activities. Two notable examples include factoring and invoice discounting as well as supply chain finance (SCF).

Factoring and invoice discounting serve as forms of receivables finance where businesses sell their accounts receivable (unpaid invoices) at a discount to financial institutions known as factors or factors-in-charge-of-collection. Factoring involves selling invoices outright to factors who then assume responsibility for collecting payments from customers directly.

Invoice discounting differs in that businesses retain control over debt collection but borrow funds against existing invoices as collateral. These non-bank financing options provide significant benefits for exporters/importers in need of immediate cash flow.

By converting outstanding invoices into cash, businesses can meet their working capital requirements and reinvest in operations more efficiently. Factoring and invoice discounting also offer advantages such as reduced administrative burden (as the factor handles collections), improved cash flow predictability, and increased liquidity.

Another non-bank financing option is Supply Chain Finance (SCF), which focuses on optimizing the financial interactions between buyers, suppliers, and financial institutions within a supply chain ecosystem. SCF allows buyers to extend payment terms to suppliers while offering them access to early payment options facilitated by financial institutions.

This arrangement benefits buyers by improving their working capital management and strengthening supplier relationships. Suppliers benefit from faster access to cash at lower interest rates than traditional financing methods.

Various techniques fall under SCF, including reverse factoring (also known as approved payables finance) where the buyer initiates early payments to suppliers based on approved invoices, as well as dynamic discounting that allows suppliers the flexibility to offer discounts for early payments while maintaining control over their receivables. Overall, non-bank financing options provide valuable alternatives for trade funding, delivering greater flexibility and efficiency for businesses engaged in international trade operations.

Government-Supported Trade Financing Programs

Export Credit Agencies (ECAs)

Export Credit Agencies play a pivotal role in promoting international trade by providing financial support and insurance to exporters and importers. These agencies, often established or supported by governments, aim to mitigate the risks associated with cross-border transactions. ECAs offer export credit insurance, which protects exporters against non-payment or default by foreign buyers.

Additionally, they provide guarantees to banks that finance these transactions, making it easier for exporters to obtain loans. The primary function of ECAs is to promote exports and enhance the competitiveness of domestic industries on the global stage.

Examples of prominent ECAs worldwide (e.g., Export-Import Bank in the US)

One notable example of an ECA is the Export-Import Bank of the United States (EXIM), which operates as an independent federal agency. EXIM provides various trade financing solutions such as direct loans, loan guarantees, and export credit insurance to support American exports.

Another prominent ECA is Euler Hermes Group based in Germany. As one of the largest global credit insurers, Euler Hermes offers comprehensive trade-related services including risk assessment, debt collection, and bonding assistance for exporters across different industries.

Multilateral Development Banks (MDBs)

Multilateral Development Banks also play a significant role in providing trade finance support on an international scale. These institutions focus on stimulating economic growth in developing countries by financing infrastructure projects and facilitating cross-border collaborations.

MDBs act as lenders or investors offering long-term financing options that mitigate risks associated with large-scale projects. Their involvement often attracts private sector investments as well.

One prominent MDB involved in trade financing initiatives is the World Bank Group (including its affiliates such as International Finance Corporation). It provides both financial resources and expertise to help countries develop their economies through sustainable trade practices.

Key MDBs involved in trade financing initiatives (e.g., World Bank Group)

Apart from the World Bank Group, other key MDBs actively engaged in trade financing include the Asian Development Bank (ADB), European Bank for Reconstruction and Development (EBRD), and the African Development Bank Group (AfDB). Each of these MDBs has its unique regional focus and provides funding to support trade-related projects such as infrastructure development, capacity building, and trade facilitation. Through their involvement, these institutions contribute to fostering economic growth and reducing poverty by enhancing global trade opportunities.

IV: Emerging Trends in Trade Funding

A: Blockchain Technology & Smart Contracts

Blockchain technology and smart contracts are emerging trends that hold significant potential to revolutionize the landscape of trade funding. Blockchain utilizes a decentralized digital ledger that allows secure and transparent recording of transactions. This technology can streamline trade finance processes by reducing paperwork, enhancing security, and increasing efficiency.

Smart contracts, which are self-executing agreements written as code on the blockchain, have the potential to automate various aspects of trade finance such as payment settlements and document verification. By eliminating intermediaries and providing immutable records, blockchain technology can enhance trust among parties involved in international trade transactions.

Conclusion

Government-supported trade financing programs play a critical role in facilitating international trade by mitigating risks for exporters and importers. Export Credit Agencies provide insurance and financial guarantees while Multilateral Development Banks offer long-term funding options for large-scale projects. These initiatives help promote economic growth in both developed and developing countries alike.

Moreover, emerging trends such as blockchain technology hold promise for transforming traditional trade finance processes through increased transparency, efficiency, and security. As these trends continue to evolve, they have the potential to unlock new opportunities for businesses around the world while fostering greater trust among trading partners.